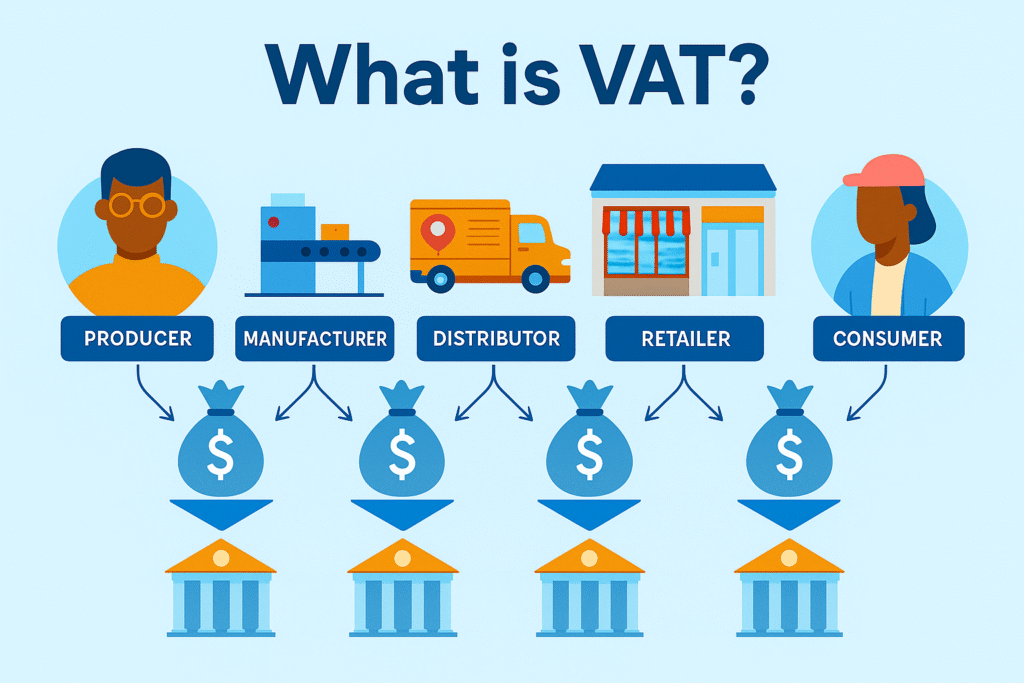

Value Added Tax, or VAT, is a type of indirect consumption tax that applies to most goods and services produced in the UK. Charges are imposed at each stage of the supply chain, from production and manufacturing to distribution, retail, and the final sale to the customer.

VAT is the tax you pay when you buy goods or services. VAT-registered businesses collect and manage it for HM Revenue & Customs (HMRC). Businesses charge VAT on what they sell (output VAT) and pay VAT on what they buy (input VAT). They then send the difference to HMRC in a VAT return. By keeping track of value addition at every step, this system makes sure that taxes are paid and that there is no tax avoidance.

Key Characteristics of VAT:

VAT is similar to a multi-stage consumption tax, and it is the primary way for the government to earn revenue all over the world. It is used in more than 160 countries, including the UK.

Here are its main features:

Indirect Tax: The final customer pays the VAT, but VAT-registered businesses collect it and remit it to the government.

Multi-Stage Collection: This applies at every level of the supply chain, from producing a product to selling it.

Destination-Based: You pay an indirect tax for goods or services where you consume the goods or services, not where the goods were produced.

Recoverable Tax: Businesses can get refunds for the VAT they paid on certain goods (called Input VAT) by taking it out of the VAT they charge on sales (Output VAT).

How Does VAT Work?

VAT operates on a credit-invoice mechanism, which requires every business in a supply chain to collect VAT on the products and services sold and recover VAT on the products purchased. This process maintains transparency and keeps VAT neutral for businesses while ensuring revenue collection for HM Revenue and Customs (HMRC).

Example of VAT Flow

| Stage | Transaction | VAT Rate | VAT Charged | VAT Paid to HMRC |

|---|---|---|---|---|

| Manufacturer | Sells goods for £100 | 20% | £20 | £20 |

| Wholesaler | Buys for £120, sells for £150 | 20% | £30 | £10 (after reclaiming £20) |

| Retailer | Buys for £180, sells for £200 | 20% | £40 | £10 (after reclaiming £30) |

Result: The total VAT collected from all stages equals £40, which is 20% of the final retail price — the true consumption tax borne by the end consumer.

Read : VAT Rates UK 2025

Who Collects VAT and How It Works

The Value Added Tax Act 1994 sets out the rules for VAT in the UK, and HM Revenue and Customs (HMRC) is in charge of it. The process to collect taxes ensures that every individual involved in the supply chain, including importers, manufacturers, retailers, and service providers, pay the appropriate amount of taxes related to their specific roles.

Main Collectors of VAT

A business that is registered for VAT must charge VAT on the goods and services it sells (output VAT) and send HMRC regular VAT returns. It can also recover the VAT paid on goods purchased for its business (input VAT).

Customs Authorities: VAT is collected at the border or through postponed VAT accounting for goods imported into the UK from outside the UK. This means that businesses can wait to pay until they file their next VAT return.

Digital Platforms: Online service providers and marketplaces use EU and UK programs like MOSS (Mini One Stop Shop) or OSS (One Stop Shop) to handle VAT for B2C (business-to-consumer) transactions that cross borders.

How to collect VAT

Domestic Sales: When a business sells products or services in the UK, it includes VAT in the price, collects the VAT from the customer, and then remits the VAT collected to HMRC, generally via the quarterly VAT return process.

Imports: When goods enter the UK, customs will take VAT. However, with postponed VAT accounting, importers can, to an extent and with some restrictions, report their VAT and reclaim it in their VAT return at the same time. This is an additional benefit to their cash flow.

Reverse Charge (B2B Transactions): In the case of specific services, such as the customer, not the supplier, is responsible for reporting and paying the VAT directly to HMRC. This makes it easier to comply with regulations regarding cross-border trade and to prevent people from evading taxes.

VAT is managed by national tax agencies in most countries. For example: HMRC in the UK, Federal Tax Service in Russia, the Australian Tax Office, Canada Revenue Agency (GST/HST) in Canada, as well as multiple member state authorities in the EU.

What’s the Purpose of VAT?

Revenue Generation:

- VAT contributes roughly 17% of the UK’s total tax revenue, making it the third-largest source after Income Tax and National Insurance.

- Its broad base ensures steady revenue, even when income taxes fluctuate.

Economic Objectives:

- Neutrality: VAT doesn’t favor domestic or imported goods.

- Transparency: The invoice system provides a clear audit trail.

- Export Incentives: Exports are usually zero-rated, making UK products more competitive abroad.

Policy Benefits:

- VAT helps governments fund infrastructure, education, healthcare, and welfare systems.

- Periodic VAT rate adjustments (like the 2020 temporary 5% cut for hospitality) can stimulate or regulate consumer spending.

Does My Business Need to Register for VAT?

Businesses must register for VAT once their VAT-taxable turnover exceeds £90,000 in 12 months (as of 2025).

Registration is done via the HMRC VAT Registration Portal.

Registration Types

- Mandatory Registration: Required when turnover exceeds the threshold.

- Voluntary Registration: Optional for smaller businesses that want to reclaim input VAT.

- Non-UK Businesses: Must register if selling or storing goods in the UK.

Benefits of Registering

- Claim VAT refunds on purchases.

- Improve business credibility for B2B clients.

- Stay compliant with HMRC and avoid penalties.

Note: You’ll receive a VAT registration number and certificate within about 30 days of approval.

Drawbacks of Registration:

- Administrative Burden: Regular filing and record-keeping

- Cash Flow Impact: Pay VAT before receiving payment

- Price Increases: May need to raise prices to cover VAT

- Compliance Costs: Accounting and legal expenses

Input VAT vs Output VAT

Understanding Input VAT and Output VAT is essential for every VAT-registered business in the UK, as they form the foundation of how VAT accounting works.

- Input VAT is the tax you pay on business-related purchases, such as raw materials, equipment, or professional services.

- Output VAT is the tax you charge customers when you sell goods or services.

At the end of each accounting period, the business calculates the Net VAT payable using this formula:

Net VAT = Output VAT – Input VAT

- If the VAT charged on sales is higher than the VAT paid on purchases, you pay the difference to HM Revenue & Customs (HMRC).

- If your Input VAT exceeds Output VAT, HMRC refunds the balance through your VAT return.

VAT Filing and Payment Process

All VAT-registered businesses are legally required to file VAT returns, typically every quarter. These returns show how much VAT was charged to customers and how much was paid on business expenses.

Your VAT return must include:

- VAT collected on sales (Output VAT)

- VAT paid on purchases (Input VAT)

- Total sales and purchases excluding VAT

- VAT due on imports or reverse charge transactions

Under the Making Tax Digital (MTD) initiative, returns must be submitted through MTD-compatible accounting software, ensuring accurate, secure, and paperless reporting directly to HMRC.

Deadlines and Penalties

- Filing Deadline: One month and seven days after the end of your accounting period.

- Late Filing: May result in fixed penalties or a points-based system of surcharges.

- Late Payment: Can lead to interest charges or a percentage penalty on the unpaid VAT amount.

Timely submission and payment are crucial to maintaining compliance and avoiding unnecessary fines.

Common VAT Exemptions

Not all goods and services in the UK are subject to VAT. Some are zero-rated (0%) while others are VAT-exempt.

| Category | Examples | VAT Treatment |

|---|---|---|

| Financial Services | Banking, insurance, investment management | Exempt |

| Healthcare | Hospitals, medical care, prescriptions | Exempt |

| Education | School and university tuition, vocational training | Exempt |

| Property | Residential rent, land sales | Exempt |

| Essential Goods | Food, books, children’s clothing | Zero-rated |

Key Difference:

- Zero-rated supplies – No VAT is charged, but businesses can reclaim input VAT on related expenses.

- Exempt supplies – No VAT is charged, and businesses cannot reclaim input VAT.

Reverse Charge Mechanism (for B2B Services)

- The reverse charge mechanism shifts VAT reporting responsibility from the supplier to the buyer.

- This system applies to certain B2B transactions, especially in cross-border services and the UK construction industry.

- It helps reduce VAT fraud and ensures fair reporting by allowing the buyer to both declare and reclaim the VAT in the same return.

Post-Brexit VAT Rules

Since 1 January 2021, the UK no longer follows the EU VAT Directive. The new system introduced several key changes:

- Northern Ireland Protocol: Northern Ireland follows EU VAT rules for goods, but UK VAT rules for services.

- Imports into Great Britain: All imports are now subject to import VAT, payable at customs or through postponed VAT accounting.

- OSS/MOSS Schemes: These special EU and UK schemes simplify VAT reporting for digital services and cross-border online sales.

Using a VAT Calculator

- For quick and accurate calculations, you can use the VAT Calculator available on VATCalc.dev.

- It allows you to add or remove VAT in real time for all UK rates (20%, 5%, and 0%), automatically computing net and gross prices.

- This helps businesses, freelancers, and consumers stay accurate and compliant without manual formulas.

Why VAT Matters

VAT is more than just a government tax—it’s a financial accountability system that promotes fairness and transparency in trade. For consumers, VAT is seamlessly built into prices they pay every day. For businesses, it’s a vital part of financial reporting, regulatory compliance, and cash flow management.

By understanding how VAT works—from input and output calculations to filing returns and exemptions—businesses can ensure accuracy, reduce errors, and operate confidently within HMRC’s digital tax framework.

VAT FAQs

General VAT Questions:

Q: What happens if I exceed the VAT threshold?

A: You must register within 30 days and start charging VAT. Retrospective registration may be required.

Q: Can I voluntarily register below the threshold?

A: Yes, voluntary registration is allowed in most countries and can be beneficial for B2B businesses.

Q: How often do VAT rates change?

A: VAT rates are relatively stable but can change due to economic policy. Brexit caused several UK rate adjustments.

Q: Do I charge VAT on exports?

A: Exports are typically zero-rated (0% VAT) but you can reclaim input VAT.

Q: What about digital services VAT?

A: Special rules apply for digital services sold to consumers in other countries (MOSS/OSS schemes).

Registration Questions:

Q: How long does VAT registration take?

A: Usually 2-6 weeks, but can be longer during busy periods.

Q: Can I backdate my VAT registration?

A: Limited backdating is possible in some circumstances, usually up to 4 years.

Q: What if I deregister and re-register?

A: There may be restrictions and tax implications. Professional advice recommended.

Calculation Questions:

Q: How do I calculate VAT on a gross amount?

A: VAT = Gross Amount × (VAT Rate ÷ (100 + VAT Rate)) Example: £120 gross at 20% = £120 × (20÷120) = £20 VAT

Q: What about VAT on tips and service charges?

A: Voluntary tips are usually not subject to VAT, but mandatory service charges are.

Q: How do I handle VAT on bad debts?

A: Bad debt relief may be available if payment is over 6 months overdue.

Compliance Questions:

Q: How long must I keep VAT records?

A: Generally 6 years, but some countries require longer retention periods.

Q: What if I make an error on my VAT return?

A: Small errors can be corrected on the next return. Larger errors may require separate disclosure.

Q: Can I get help with VAT compliance?

A: Yes, most tax authorities offer guidance, and professional advisers specialize in VAT.

International Questions:

Q: Do I need to register for VAT in every country I sell to?

A: Not necessarily. Distance selling thresholds and special schemes (OSS/MOSS) may apply.

Q: How does VAT work for services provided internationally?

A: Complex rules based on supplier/customer location and type. B2B often uses reverse charge.

Q: What about VAT on imports from outside the EU/UK?

A: Import VAT is typically due at the border, but postponed accounting may be available.